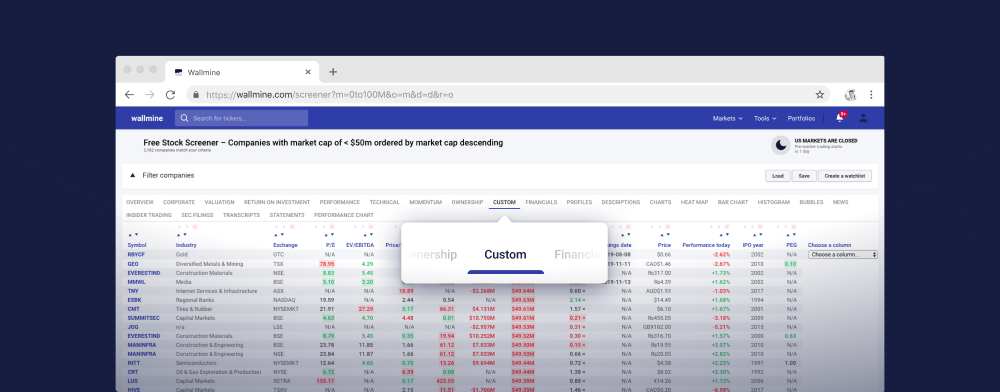

Free Stock Screener

Load Save Create a watchlist Help| Symbol | Company | Exchange | Industry | Market cap | EBITDA | P/E | EV/EBITDA | Debt/Equity | Average volume | Institutional ownership | Price | Performance today | Choose a column |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| APC | Apple Inc. | XETRA | Consumer Electronics | $1.98T | $130.541B | 27.85 | 17.34 | 5.96 | 50.467k | 59.56% | €200.35 | +0.53% | Clear columns |

| AAPL | Apple Inc | NASDAQ | Consumer Electronics | $1.97T | $129.629B | 33.17 | 23.04 | 4.67 | 64.002M | 59.56% | $214.29 | -1.10% | |

| MSF | Microsoft Corporation | EURONEXT | Internet Services & Infrastructure | $1.92T | $98.841B | 36.46 | 18.92 | 1.19 | 3.000 | 71.76% | $319.20 | +2.32% | |

| MSFT | Microsoft Corporation | NASDAQ | Internet Services & Infrastructure | $1.87T | $125.543B | 38.51 | 25.28 | 1.00 | 20.745M | 72.12% | $446.34 | -0.45% | |

| 4338 | Microsoft Corporation | HKSE | Internet Services & Infrastructure | $1.79T | $97.983B | 20.81 | 17.83 | 1.00 | 0.000 | 72.12% | HKD$1,600.00 | -10.36% | |

| GOOG | Alphabet Inc | NASDAQ | Internet Services & Infrastructure | $1.23T | $103.970B | 3.56 | 18.84 | 1.39 | 14.560M | 66.22% | $176.45 | -1.30% | |

| GOOGL | Alphabet Inc | NASDAQ | Internet Services & Infrastructure | $1.23T | $103.970B | 26.65 | 18.84 | 0.42 | 37.062M | 79.33% | $175.09 | -1.21% | |

| AMZ | Amazon.com, Inc. | XETRA | Internet & Direct Marketing Retail | $862.31B | $51.549B | 146.46 | 18.41 | 2.04 | 47.616k | 60.44% | €170.74 | +0.88% | |

| 0HD6 | Alphabet Inc. | LSE | n/a | $859.66B | $96.887B | 19.93 | N/A | 0.43 | 205.495k | 66.22% | $114.939 | +0.44% | |

| BRK-B | Berkshire Hathaway Inc. | NYSE | Multi-line Insurance | $682.01B | $26.516B | 12.06 | 29.12 | 0.89 | 2.626M | 65.47% | $407.95 | +0.15% | |

| BRK-A | Berkshire Hathaway Inc. | NYSE | Multi-line Insurance | $673.66B | $26.516B | 37.26 | 29.66 | 0.88 | 12.234k | 20.27% | $615,000.00 | +0.19% | |

| META | Meta Platforms Inc | NASDAQ | Internet Services & Infrastructure | $542.80B | $65.370B | 27.98 | 15.69 | 0.50 | 9.832M | 75.31% | $499.49 | -1.41% | |

| UNH | Unitedhealth Group Inc | NYSE | Managed Health Care | $503.80B | $36.202B | 29.00 | 15.34 | 1.97 | 4.807M | 90.12% | $481.05 | -1.67% | |

| UNH | UnitedHealth Group Incorporated | XETRA | Healthcare Plans | $499.33B | $29.351B | 32.51 | 18.21 | 1.77 | 564.000 | 89.62% | €449.70 | -0.63% | |

| TSLA | Tesla Inc | NASDAQ | Automobile Manufacturers | $495.14B | $10.554B | 42.99 | 54.35 | 0.69 | 86.718M | 44.20% | $184.86 | -1.38% | |

| TL0 | Tesla, Inc. | XETRA | Automobile Manufacturers | $481.07B | $16.010B | 39.57 | 29.12 | 1.01 | 83.528k | 44.20% | €171.68 | +0.54% | |

| JNJ | Johnson & Johnson | NYSE | Pharmaceuticals | $459.47B | $28.853B | 9.54 | 12.87 | 1.44 | 7.022M | 70.32% | $145.65 | -0.21% | |

| XOM | Exxon Mobil Corp. | NYSE | Integrated Oil & Gas | $449.25B | $71.039B | 13.40 | 6.64 | 0.80 | 16.046M | 58.87% | $109.38 | +0.94% | |

| V | Visa Inc | NYSE | Consumer Finance | $447.43B | $23.885B | 30.61 | 18.51 | 1.34 | 6.435M | 96.02% | $273.62 | +0.90% | |

| XONA | Exxon Mobil Corp. | XETRA | Integrated Oil & Gas | $439.57B | $69.708B | 8.29 | 6.91 | 0.97 | 3.308k | 56.95% | €101.84 | -0.27% | |

| CHTEX | Chevron Corporation | EURONEXT | Integrated Oil & Gas | $439.52B | $47.275B | N/A | 7.62 | 0.72 | 0.000 | 71.86% | $170.32 | +0.85% | |

| NVDA | NVIDIA Corp | NASDAQ | Semiconductors | $422.44B | $34.480B | 78.51 | 67.58 | 0.53 | 60.376M | 65.16% | $135.58 | +3.51% | |

| TSM | Taiwan Semiconductor Manufacturing | NYSE | Semiconductors | $418.46B | NT$49.085B | 88.08 | 466.69 | 0.71 | 11.951M | 17.36% | $179.69 | +1.38% | |

| NVD | NVIDIA Corporation | XETRA | Semiconductors | $405.69B | $8.718B | 36.52 | 46.38 | 0.66 | 5.052k | 65.79% | €129.88 | +4.39% | |

| TCEHY | Tencent Holdings Ltd. | OTC | Internet Services & Infrastructure | $399.92B | ¥153.593B | 35.93 | 18.09 | 0.91 | 2.558M | 0.60% | $48.69 | -0.47% | |

| TCTZF | Tencent Holdings Ltd. | OTC | Internet Services & Infrastructure | $399.92B | ¥153.593B | 18.77 | 18.09 | 1.02 | 35.716k | 22.45% | $48.97 | +1.75% | |

| WMT | Walmart Inc | NYSE | Hypermarkets & Super Centers | $395.54B | $38.865B | 28.85 | 14.46 | 1.93 | 17.445M | 32.13% | $67.60 | +0.27% | |

| JPM | JPMorgan Chase & Co. | NYSE | Diversified Banks | $391.32B | $70.805B | 11.87 | 8.09 | 10.82 | 12.978M | 71.74% | $197.00 | +1.04% | |

| 0700 | Tencent Holdings Limited | HKSE | Internet Services & Infrastructure | $384.40B | ¥154.658B | 18.48 | 17.82 | 1.02 | 24.264M | 22.24% | HKD$389.00 | +3.18% | |

| LVMHF | LVMH Moët Hennessy Louis Vuitton SE | OTC | Apparel, Accessories & Luxury Goods | $377.48B | €22.448B | 67.82 | 17.63 | 1.62 | 1.518k | 21.42% | $762.00 | -1.80% | |

| LVMUY | LVMH Moët Hennessy Louis Vuitton SE | OTC | Apparel, Accessories & Luxury Goods | $377.48B | €22.448B | 54.89 | 17.63 | 1.62 | 159.946k | 0.54% | $152.46 | -1.70% | |

| MC | LVMH Moët Hennessy Louis Vuitton SE | EURONEXT | Apparel, Accessories & Luxury Goods | $361.79B | €22.448B | 76.19 | 17.17 | 1.62 | 287.697k | 21.42% | €706.30 | -0.54% | |

| 0KZC | SPDR S&P 500 ETF Trust | LSE | n/a | $361.70B | N/A | 5.72 | N/A | 0.00 | 61.071k | 67.87% | $549.30 | +0.25% | |

| PG | Procter & Gamble Co. | NYSE | Household & Personal Products | $357.63B | $23.004B | 26.80 | 18.37 | 1.58 | 6.073M | 65.74% | $168.56 | +0.63% | |

| PRG | Procter & Gamble Co. | XETRA | Household & Personal Products | $351.90B | $21.364B | 29.35 | 17.71 | 1.54 | 1.582k | 65.74% | €156.82 | +0.18% | |

| LLY | Lilly(Eli) & Co | NYSE | Pharmaceuticals | $343.00B | $12.912B | 130.71 | 60.95 | 4.93 | 2.160M | 84.30% | $891.46 | +0.73% | |

| MA | Mastercard Incorporated | NYSE | Consumer Finance | $340.21B | $15.754B | 35.67 | 27.39 | 5.12 | 2.166M | 78.53% | $450.11 | +0.45% | |

| HDI | The Home Depot, Inc. | XETRA | Home Improvement Retail | $330.18B | $26.942B | 21.47 | 13.96 | -43.38 | 345.000 | 71.07% | €332.45 | +1.01% | |

| CVX | Chevron Corp. | NYSE | Integrated Oil & Gas | $329.71B | $47.335B | 14.04 | 6.57 | 0.62 | 9.166M | 71.60% | $153.33 | +0.09% | |

| HD | Home Depot, Inc. | NYSE | Home Improvement Retail | $326.63B | $24.362B | 23.64 | 15.34 | 72.30 | 2.994M | 71.07% | $353.87 | +1.25% | |

| NSRGY | Nestlé SA | OTC | Packaged Foods & Meats | $320.94B | CHF18.073B | 40.10 | 19.74 | 1.61 | 670.162k | 1.59% | $107.22 | +0.28% | |

| CHV | Chevron Corporation | XETRA | Integrated Oil & Gas | $320.20B | $47.275B | N/A | 7.56 | 0.72 | 2.046k | 71.86% | €143.08 | -0.11% | |

| NSRGF | Nestlé SA | OTC | Packaged Foods & Meats | $319.44B | CHF18.073B | 29.20 | 19.74 | 2.48 | 16.394k | 39.99% | $107.00 | +0.08% | |

| FB2A | Facebook, Inc. | XETRA | Internet Services & Infrastructure | $313.25B | $43.867B | 6.85 | 6.79 | 0.50 | 16.859k | 76.94% | €465.90 | -0.14% | |

| SMSN | Samsung Electronics Co Ltd | LSE | Consumer Electronics | $310.43B | ₩90.944T | 13.24 | 3.19 | 0.41 | 11.944k | 1.50% | $1,480.00 | +0.54% | |

| BC94 | Samsung Electronics Co., Ltd. | LSE | Electrical Components & Equipment | $310.43B | ₩91.588T | 13.46 | 3.17 | 0.41 | 4.067k | 1.50% | $1,480.00 | +2.17% | |

| 0TDD | Novo Nordisk A/S | LSE | n/a | $305.33B | kr72.022B | 42.04 | N/A | 1.75 | 19.345k | 8.30% | $140.51 | -0.25% | |

| NONOF | Novo Nordisk A/S | OTC | Biotechnology | $294.46B | kr77.649B | 40.67 | 27.54 | 1.75 | 24.825k | 41.07% | $140.00 | -2.09% | |

| NVO | Novo Nordisk | NYSE | Biotechnology | $293.86B | N/A | 57.47 | N/A | N/A | 3.591M | 8.30% | $140.80 | +0.31% | |

| PFE | Pfizer Inc. | NYSE | Pharmaceuticals | $291.64B | $7.419B | N/A | 29.58 | 1.54 | 28.251M | 69.08% | $27.41 | +1.59% |