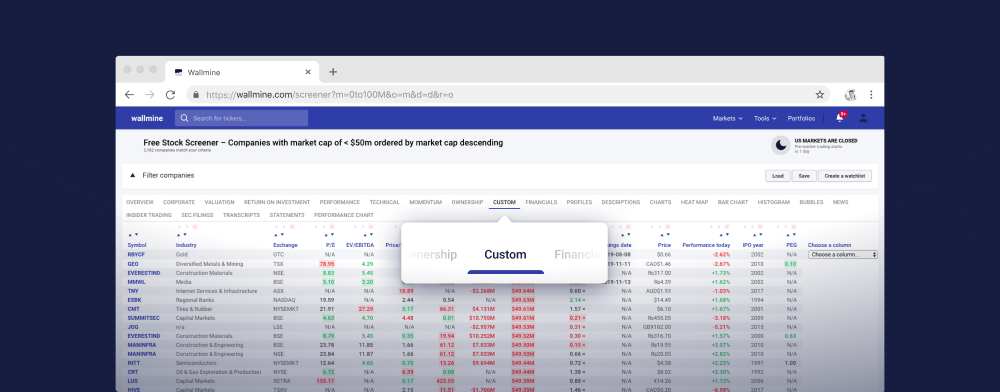

Free Stock Screener

Load Save Create a watchlist Help| Market cap | $1.97T |

|---|---|

| Enterprise value | $2.99T |

| Revenue | $381.623B |

|---|---|

| EBITDA | $129.629B |

| Income | $100.389B |

| Revenue Q/Q | -4.31% |

| Revenue Y/Y | -0.90% |

| P/E | 33.17 |

|---|---|

| Forward P/E | 29.17 |

| EV/Sales | 7.83 |

| EV/EBITDA | 23.04 |

| EV/EBIT | 24.87 |

| PEG | 2.75 |

| Price/Sales | 5.17 |

| P/FCF | 19.36 |

| Price/Book | 31.74 |

| Book/Share | 6.75 |

| Cash/Share | 6.69 |

| FCF yield | 5.17% |

| Volume | 79.685M / 64.002M |

|---|---|

| Relative vol. | 1.25 × |

| EPS | 6.46 |

|---|---|

| EPS Q/Q | 4.03% |

| Est. EPS Q/Q | -5.71% |

| Profit margin | 25.31% |

|---|---|

| Oper. margin | 30.98% |

| Gross margin | 44.13% |

| EBIT margin | 31.47% |

| EBITDA margin | 33.97% |

| Ret. on assets | 29.13% |

|---|---|

| Ret. on equity | 148.33% |

| ROIC | 33.37% |

| ROCE | 56.24% |

| Debt/Equity | 4.67 |

|---|---|

| Net debt/EBITDA | 1.30 |

| Current ratio | 1.04 |

| Quick ratio | 0.99 |

| Volatility | 2.21% |

|---|---|

| Beta | 1.08 |

| RSI | 73.56 |

|---|

| Insider ownership | 0.07% |

|---|---|

| Inst. ownership | 59.56% |

| Shares outst. | 15.334B |

|---|---|

| Shares float | 0.000 0.00% |

| Short % of float | 0.68% |

| Short ratio | 1.11 |

| Dividend | $0.97 |

|---|---|

| Dividend yield | 0.45% |

| Payout ratio | 15.02% |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | 1 Aug 2024 |

| Market cap | $1.87T |

|---|---|

| Enterprise value | $3.17T |

| Revenue | $236.584B |

|---|---|

| EBITDA | $125.543B |

| Income | $86.181B |

| Revenue Q/Q | 17.03% |

| Revenue Y/Y | 13.97% |

| P/E | 38.51 |

|---|---|

| Forward P/E | 39.90 |

| EV/Sales | 13.42 |

| EV/EBITDA | 25.28 |

| EV/EBIT | 29.40 |

| PEG | 2.17 |

| Price/Sales | 7.90 |

| P/FCF | 26.48 |

| Price/Book | 9.06 |

| Book/Share | 49.25 |

| Cash/Share | 26.57 |

| FCF yield | 3.78% |

| Volume | 16.377M / 20.745M |

|---|---|

| Relative vol. | 0.79 × |

| EPS | 11.59 |

|---|---|

| EPS Q/Q | 3.52% |

| Est. EPS Q/Q | -5.24% |

| Profit margin | 34.15% |

|---|---|

| Oper. margin | 44.70% |

| Gross margin | 68.92% |

| EBIT margin | 45.64% |

| EBITDA margin | 53.06% |

| Ret. on assets | 19.02% |

|---|---|

| Ret. on equity | 37.54% |

| ROIC | 23.50% |

| ROCE | 29.52% |

| Debt/Equity | 1.00 |

|---|---|

| Net debt/EBITDA | -0.82 |

| Current ratio | 1.24 |

| Quick ratio | 1.23 |

| Volatility | 1.58% |

|---|---|

| Beta | 1.23 |

| RSI | 69.77 |

|---|

| Insider ownership | 0.08% |

|---|---|

| Inst. ownership | 72.12% |

| Shares outst. | 7.432B |

|---|---|

| Shares float | 0.000 0.00% |

| Short % of float | 0.51% |

| Short ratio | 1.28 |

| Dividend | $2.93 |

|---|---|

| Dividend yield | 0.65% |

| Payout ratio | 25.28% |

| Payment date | 12 Sep 2024 |

| Ex-dividend date | 15 Aug 2024 |

| Earnings date | 30 Jul 2024 |

GOOG

| Market cap | $1.23T |

|---|---|

| Enterprise value | $1.96T |

| Revenue | $318.146B |

|---|---|

| EBITDA | $103.970B |

| Income | $66.990B |

| Revenue Q/Q | 6.10% |

| Revenue Y/Y | 17.94% |

| P/E | 3.56 |

|---|---|

| Forward P/E | 29.64 |

| EV/Sales | 6.16 |

| EV/EBITDA | 18.84 |

| EV/EBIT | 30.85 |

| PEG | 1.34 |

| Price/Sales | 4.37 |

| P/FCF | 19.70 |

| Price/Book | 8.16 |

| Book/Share | 21.63 |

| Cash/Share | 19.24 |

| FCF yield | 5.08% |

| Volume | 14.976M / 14.560M |

|---|---|

| Relative vol. | 1.03 × |

| EPS | 49.59 |

|---|---|

| EPS Q/Q | -24.29% |

| Est. EPS Q/Q | -20.26% |

| Profit margin | 25.90% |

|---|---|

| Oper. margin | 27.85% |

| Gross margin | 57.13% |

| EBIT margin | 27.85% |

| EBITDA margin | 32.68% |

| Ret. on assets | 18.74% |

|---|---|

| Ret. on equity | 26.41% |

| ROIC | 19.43% |

| ROCE | 26.88% |

| Debt/Equity | 1.39 |

|---|---|

| Net debt/EBITDA | -9.84 |

| Current ratio | 2.52 |

| Quick ratio | 2.47 |

| Volatility | 1.85% |

|---|---|

| Beta | 1.35 |

| RSI | 53.68 |

|---|

| Insider ownership | 0.04% |

|---|---|

| Inst. ownership | 66.22% |

| Shares outst. | 5.617B |

|---|---|

| Shares float | 0.000 0.00% |

| Short % of float | 0.00% |

| Short ratio | 1.07 |

| Dividend | $0.20 |

|---|---|

| Dividend yield | 0.11% |

| Payout ratio | 0.40% |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | 23 Jul 2024 |

GOOGL

| Market cap | $1.23T |

|---|---|

| Enterprise value | $1.96T |

| Revenue | $318.146B |

|---|---|

| EBITDA | $103.970B |

| Income | $82.406B |

| Revenue Q/Q | 15.41% |

| Revenue Y/Y | 11.78% |

| P/E | 26.65 |

|---|---|

| Forward P/E | 29.26 |

| EV/Sales | 6.16 |

| EV/EBITDA | 18.84 |

| EV/EBIT | 20.37 |

| PEG | 1.34 |

| Price/Sales | 3.87 |

| P/FCF | 17.83 |

| Price/Book | 4.35 |

| Book/Share | 40.27 |

| Cash/Share | 15.76 |

| FCF yield | 5.61% |

| Volume | 21.506M / 37.062M |

|---|---|

| Relative vol. | 0.58 × |

| EPS | 6.57 |

|---|---|

| EPS Q/Q | -24.29% |

| Est. EPS Q/Q | -22.22% |

| Profit margin | 24.01% |

|---|---|

| Oper. margin | 29.03% |

| Gross margin | 56.63% |

| EBIT margin | 30.22% |

| EBITDA margin | 32.68% |

| Ret. on assets | 20.74% |

|---|---|

| Ret. on equity | 29.52% |

| ROIC | 22.41% |

| ROCE | 29.10% |

| Debt/Equity | 0.42 |

|---|---|

| Net debt/EBITDA | -3.40 |

| Current ratio | 2.15 |

| Quick ratio | 2.15 |

| Volatility | 1.89% |

|---|---|

| Beta | 1.35 |

| RSI | 54.23 |

|---|

| Insider ownership | 7.73% |

|---|---|

| Inst. ownership | 79.33% |

| Shares outst. | 12.609B |

|---|---|

| Shares float | 0.000 0.00% |

| Short % of float | 0.82% |

| Short ratio | 1.44 |

| Dividend | $0.20 |

|---|---|

| Dividend yield | 0.11% |

| Payout ratio | 3.04% |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | 23 Jul 2024 |

| Market cap | $682.01B |

|---|---|

| Enterprise value | $772.04B |

| Revenue | $410.931B |

|---|---|

| EBITDA | $26.516B |

| Income | $73.421B |

| Revenue Q/Q | -23.64% |

| Revenue Y/Y | 43.93% |

| P/E | 12.06 |

|---|---|

| Forward P/E | 21.46 |

| EV/Sales | 1.88 |

| EV/EBITDA | 29.12 |

| EV/EBIT | 8.09 |

| PEG | 10.17 |

| Price/Sales | 1.66 |

| P/FCF | 22.01 |

| Price/Book | 1.22 |

| Book/Share | 335.73 |

| Cash/Share | 71,837.86 |

| FCF yield | 4.54% |

| Volume | 3.431M / 2.626M |

|---|---|

| Relative vol. | 1.31 × |

| EPS | 33.84 |

|---|---|

| EPS Q/Q | 43.69% |

| Est. EPS Q/Q | -6.97% |

| Profit margin | 21.90% |

|---|---|

| Oper. margin | 22.98% |

| Gross margin | 34.10% |

| EBIT margin | 23.22% |

| EBITDA margin | 6.45% |

| Ret. on assets | 6.99% |

|---|---|

| Ret. on equity | 13.36% |

| ROIC | 12.42% |

| ROCE | 8.92% |

| Debt/Equity | 0.89 |

|---|---|

| Net debt/EBITDA | 13.07 |

| Current ratio | 1.38 |

| Quick ratio | 1.18 |

| Volatility | 1.15% |

|---|---|

| Beta | 0.90 |

| RSI | 48.84 |

|---|

| Insider ownership | 0.45% |

|---|---|

| Inst. ownership | 65.47% |

| Shares outst. | 1.303B |

|---|---|

| Shares float | 1.207M 0.09% |

| Short % of float | 0.54% |

| Short ratio | 1.41 |

| Dividend | N/A |

|---|---|

| Dividend yield | N/A |

| Payout ratio | N/A |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

| Market cap | $673.66B |

|---|---|

| Enterprise value | $786.58B |

| Revenue | $224.912B |

|---|---|

| EBITDA | $26.516B |

| Income | -$50.55 |

| Revenue Q/Q | 9.00% |

| Revenue Y/Y | N/A |

| P/E | 37.26 |

|---|---|

| Forward P/E | 21.88 |

| EV/Sales | 3.50 |

| EV/EBITDA | 29.66 |

| EV/EBIT | N/A |

| PEG | 9.68 |

| Price/Sales | 3.00 |

| P/FCF | 32.19 |

| Price/Book | 1.64 |

| Book/Share | 373,008.18 |

| Cash/Share | 108,114.37 |

| FCF yield | 3.11% |

| Volume | 1.859k / 12.234k |

|---|---|

| Relative vol. | 0.15 × |

| EPS | 16,408.39 |

|---|---|

| EPS Q/Q | 39.00% |

| Est. EPS Q/Q | 6.46% |

| Profit margin | 32.52% |

|---|---|

| Oper. margin | -28.01% |

| Gross margin | 41.60% |

| EBIT margin | -3.72% |

| EBITDA margin | 11.79% |

| Ret. on assets | 1.08% |

|---|---|

| Ret. on equity | 2.69% |

| ROIC | 10.29% |

| ROCE | -1.08% |

| Debt/Equity | 0.88 |

|---|---|

| Net debt/EBITDA | -1.09 |

| Current ratio | 1.46 |

| Quick ratio | 1.26 |

| Volatility | 1.84% |

|---|---|

| Beta | 0.90 |

| RSI | 44.89 |

|---|

| Range | $610,100.00 – $615,000.00 |

|---|---|

| 52 weeks | $504,050.06 – $741,971.00 |

| SMA 50 | $616,617 -0.26% |

| SMA 200 | $595,847 +3.11% |

| Insider ownership | 42.91% |

|---|---|

| Inst. ownership | 20.27% |

| Shares outst. | 619.938k |

|---|---|

| Shares float | 1.207M 194.67% |

| Short % of float | 0.20% |

| Short ratio | 0.25 |

| Dividend | N/A |

|---|---|

| Dividend yield | N/A |

| Payout ratio | N/A |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

| Market cap | $542.80B |

|---|---|

| Enterprise value | $1.03T |

| Revenue | $142.711B |

|---|---|

| EBITDA | $65.370B |

| Income | $45.757B |

| Revenue Q/Q | 27.26% |

| Revenue Y/Y | 21.62% |

| P/E | 27.98 |

|---|---|

| Forward P/E | 38.32 |

| EV/Sales | 7.19 |

| EV/EBITDA | 15.69 |

| EV/EBIT | 18.89 |

| PEG | 1.15 |

| Price/Sales | 3.80 |

| P/FCF | 10.91 |

| Price/Book | 3.54 |

| Book/Share | 140.95 |

| Cash/Share | 60.18 |

| FCF yield | 9.16% |

| Volume | 12.806M / 9.832M |

|---|---|

| Relative vol. | 1.30 × |

| EPS | 17.85 |

|---|---|

| EPS Q/Q | -49.07% |

| Est. EPS Q/Q | -36.51% |

| Profit margin | 28.98% |

|---|---|

| Oper. margin | 37.38% |

| Gross margin | 80.76% |

| EBIT margin | 38.05% |

| EBITDA margin | 45.81% |

| Ret. on assets | 20.91% |

|---|---|

| Ret. on equity | 31.58% |

| ROIC | 22.84% |

| ROCE | 27.88% |

| Debt/Equity | 0.50 |

|---|---|

| Net debt/EBITDA | -1.39 |

| Current ratio | 2.68 |

| Quick ratio | 2.68 |

| Volatility | 2.22% |

|---|---|

| Beta | 1.77 |

| RSI | 58.37 |

|---|

| Insider ownership | 0.55% |

|---|---|

| Inst. ownership | 75.31% |

| Shares outst. | 2.690B |

|---|---|

| Shares float | 0.000 0.00% |

| Short % of float | 1.14% |

| Short ratio | 0.79 |

| Dividend | $1.00 |

|---|---|

| Dividend yield | 0.20% |

| Payout ratio | 5.60% |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | 24 Jul 2024 |

| Market cap | $503.80B |

|---|---|

| Enterprise value | $555.50B |

| Revenue | $379.487B |

|---|---|

| EBITDA | $36.202B |

| Income | $15.361B |

| Revenue Q/Q | 8.56% |

| Revenue Y/Y | 12.96% |

| P/E | 29.00 |

|---|---|

| Forward P/E | 18.51 |

| EV/Sales | 1.46 |

| EV/EBITDA | 15.34 |

| EV/EBIT | 22.83 |

| PEG | 1.66 |

| Price/Sales | 1.33 |

| P/FCF | 47.91 |

| Price/Book | 5.68 |

| Book/Share | 84.75 |

| Cash/Share | 31.88 |

| FCF yield | 2.09% |

| Volume | 3.628M / 4.807M |

|---|---|

| Relative vol. | 0.75 × |

| EPS | 16.59 |

|---|---|

| EPS Q/Q | 28.10% |

| Est. EPS Q/Q | 15.18% |

| Profit margin | 6.02% |

|---|---|

| Oper. margin | 8.49% |

| Gross margin | 24.48% |

| EBIT margin | 6.41% |

| EBITDA margin | 9.54% |

| Ret. on assets | 5.49% |

|---|---|

| Ret. on equity | 17.95% |

| ROIC | 12.62% |

| ROCE | 13.53% |

| Debt/Equity | 1.97 |

|---|---|

| Net debt/EBITDA | 2.70 |

| Current ratio | 0.85 |

| Quick ratio | 0.85 |

| Volatility | 2.15% |

|---|---|

| Beta | 0.12 |

| RSI | 38.40 |

|---|

| Insider ownership | 0.47% |

|---|---|

| Inst. ownership | 90.12% |

| Shares outst. | 920.385M |

|---|---|

| Shares float | 0.000 0.00% |

| Short % of float | 0.49% |

| Short ratio | 1.24 |

| Dividend | $7.74 |

|---|---|

| Dividend yield | 1.61% |

| Payout ratio | 46.65% |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | 16 Jul 2024 |

| Market cap | $495.14B |

|---|---|

| Enterprise value | $573.60B |

| Revenue | $94.745B |

|---|---|

| EBITDA | $10.554B |

| Income | $13.613B |

| Revenue Q/Q | -8.69% |

| Revenue Y/Y | 10.12% |

| P/E | 42.99 |

|---|---|

| Forward P/E | 34.11 |

| EV/Sales | 6.05 |

| EV/EBITDA | 54.35 |

| EV/EBIT | 64.00 |

| PEG | 1.28 |

| Price/Sales | 5.23 |

| P/FCF | 358.27 |

| Price/Book | 7.91 |

| Book/Share | 23.38 |

| Cash/Share | 10.86 |

| FCF yield | 0.28% |

| Volume | 68.689M / 86.718M |

|---|---|

| Relative vol. | 0.79 × |

| EPS | 4.30 |

|---|---|

| EPS Q/Q | -43.55% |

| Est. EPS Q/Q | 47.06% |

| Profit margin | 15.50% |

|---|---|

| Oper. margin | 7.81% |

| Gross margin | 18.25% |

| EBIT margin | 9.46% |

| EBITDA margin | 11.14% |

| Ret. on assets | 13.60% |

|---|---|

| Ret. on equity | 23.51% |

| ROIC | 10.87% |

| ROCE | 11.24% |

| Debt/Equity | 0.69 |

|---|---|

| Net debt/EBITDA | -8.32 |

| Current ratio | 1.72 |

| Quick ratio | 1.17 |

| Volatility | 4.16% |

|---|---|

| Beta | 1.97 |

| RSI | 56.97 |

|---|

| Insider ownership | 16.43% |

|---|---|

| Inst. ownership | 44.20% |

| Shares outst. | 3.133B |

|---|---|

| Shares float | 0.000 0.00% |

| Short % of float | 3.00% |

| Short ratio | 0.88 |

| Dividend | N/A |

|---|---|

| Dividend yield | N/A |

| Payout ratio | N/A |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | 17 Jul 2024 |

| Market cap | $459.47B |

|---|---|

| Enterprise value | $371.40B |

| Revenue | $81.796B |

|---|---|

| EBITDA | $28.853B |

| Income | $38.476B |

| Revenue Q/Q | -13.59% |

| Revenue Y/Y | -15.03% |

| P/E | 9.54 |

|---|---|

| Forward P/E | 13.89 |

| EV/Sales | 4.54 |

| EV/EBITDA | 12.87 |

| EV/EBIT | 8.83 |

| PEG | 3.79 |

| Price/Sales | 5.62 |

| P/FCF | 24.57 |

| Price/Book | 6.68 |

| Book/Share | 21.80 |

| Cash/Share | 7.27 |

| FCF yield | 4.07% |

| Volume | 6.035M / 7.022M |

|---|---|

| Relative vol. | 0.86 × |

| EPS | 15.26 |

|---|---|

| EPS Q/Q | -1.92% |

| Est. EPS Q/Q | 4.69% |

| Profit margin | 41.28% |

|---|---|

| Oper. margin | 25.24% |

| Gross margin | 68.82% |

| EBIT margin | 51.41% |

| EBITDA margin | 35.27% |

| Ret. on assets | 22.07% |

|---|---|

| Ret. on equity | 53.97% |

| ROIC | 21.22% |

| ROCE | 34.12% |

| Debt/Equity | 1.44 |

|---|---|

| Net debt/EBITDA | 1.29 |

| Current ratio | 1.17 |

| Quick ratio | 0.94 |

| Volatility | 1.42% |

|---|---|

| Beta | 0.22 |

| RSI | 41.96 |

|---|

| Insider ownership | 0.09% |

|---|---|

| Inst. ownership | 70.32% |

| Shares outst. | 2.407B |

|---|---|

| Shares float | 0.000 0.00% |

| Short % of float | 0.49% |

| Short ratio | 1.94 |

| Dividend | $4.81 |

|---|---|

| Dividend yield | 3.30% |

| Payout ratio | 31.52% |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | 17 Jul 2024 |